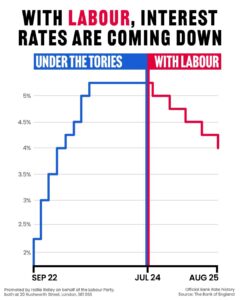

Homebuyers are £1,000 better off on their mortgage thanks to the new Government, analysis has found.

Since the election, interest rates have been cut five times, showing stability has returned to the UK economy.

As the Bank of England cut interest rates last week, new figures released show families buying a typical home now pay £980.26 less per year on their mortgage, compared to July 2024.

The win for working families comes after the Chancellor took the emergency action required to fix the foundations of our economy.

The cheaper rates available today – with the average two-year fixed rate falling to 4.52 per cent – has saved working people £81.69 on average each month, meaning more money back in their pockets.

Rawmarsh and Conisbrough MP, John Healey, said:

“The urgent task when we took office was to restore stability to the economy and since then rates have been cut five times, putting more money in the pockets of homeowners locally through cheaper mortgages.

“The savings are a welcome relief to families, but we know that there’s still more to be done.

“Through our Plan for Change we have begun delivering an economy that works for working people.”

It comes alongside the wider cost of living support introduced by the Government through the Plan for Change.

That includes the fuel duty freeze, the protection of the pensions triple lock, the expansion of free school meals, and the delivery of free breakfast clubs for primary school kids.

Prime Minister Keir Starmer has secured three historic trade deals with the US, India and the EU, which are also set to further benefit families – cutting costs on the essentials in supermarkets.